Roll over 401k to roth ira tax calculator

Move funds from a 401k from a previous employer to an IRA. Thats considered an early withdrawal and youll get.

Download Roth Ira Calculator Excel Template Exceldatapro

A Roth IRA is an individual retirement account that offers the opportunity for tax-free income in retirement.

. Moving after-tax money into a Roth IRA can help diversify retirement portfolios. Wait for two years from the date of plan participation before you carry out the rollover to a 401k if you want to avoid paying taxes. Best alternatives to a 401k Best Roth IRA accounts.

Or you can move the assets into another SIMPLE IRA at any time. An eligible rollover of funds from one IRA to another is a non-taxable transaction. Learn about Roth IRA conversion.

Because Roth IRAs are funded with after-tax dollars youll have to pay taxes on your existing 401k funds at the time of the conversion. A Roth IRA must be open for five years in order to. Voluntary after-tax solo 401k contributions can be distributed and thus converted at any time.

Open an IRA or roll over a 401k 403b or governmental 457b plan to an IRA. Iii you are disabled. Leave your assets in a previous employers plan cash out your 401k initiate a 401k rollover into a new employers plan or rollover into an IRA Traditional or Roth.

A 401k rollover to IRA could be right for you if youre changing jobs retiring soon or already enjoying retirement. You can legally roll over SIMPLE IRA assets into a 401k plan but the tax treatment of the rollover will be dictated by the rollover date. Since you invest in your Roth IRA with money thats already been taxed the money inside the account grows tax-free and you wont pay a dime in taxes when you withdraw your money at retirement.

You may gain tax benefits by converting funds from employer-sponsored retirement plans such as a 401k into a Roth IRA. What is a spousal IRA. Roth IRAs are also exempt from RMDs.

We will help you understand the potential considerations of what a 401k has to offer. Unlike a 401k you contribute to a Roth IRA with after-tax money. Ii you are a qualified first-time home buyer lifetime limit of 10000.

Footnote 7 Distributions from a Roth IRA are not subject to federal income tax provided you have satisfied a five-year holding period and at least one of the following applies. This is why the conversion of voluntary after-tax solo 401k contributions has been dubbed the mega-backdoor Roth solo 401k There is a lesser known rule called the overall 415 limits. A Roth 401k is an employer-sponsored retirement plan thats funded by after-tax dollars.

And you should never ever withdraw the money yourself to roll overdont even touch it. However if you are not yet age 59 12 you may not want to do this because once it becomes your own IRA any distributions you take will be considered early distributions and subject to a 10 penalty tax as well as regular income taxes. No taxes will be imposed on rollovers.

There will be no taxes on this transaction. I you are 59½ or older. The infographic below explains four options to consider.

Please verify with your plan administrator that your distribution is eligible for a rolloverconversion. Keep in mind that traditional IRAs also require minimum distributions at age 72. As a result the assets in your retirement account remain tax-deferred.

Withdrawals are entirely tax-free in retirement provided youre over age 59½ and have held the account for five years or more. You can roll over the 401k plan to your own IRA account. 401K rollover funds are reported as distributions even when they are rolled over into another eligible retirement account.

Now you can potentially roll over your traditional 401k into a Roth IRA a Roth conversion but there are big tax implications to considermeaning it might not be the right choice for everyone. Best places to roll over your 401k Best retirement plans for self-employed. Roth contribution withdrawals are generally tax- and penalty-free as long as the withdrawal occurs at least five years after the tax year in which you first made a Roth 401k contribution and.

It shares certain similarities with a traditional 401k and a Roth IRA although there are important. Both Roth and traditional IRAs generally offer more investment options. Rollover distributions are exempt from tax when you place the funds in another IRA account within 60 days from the date of distribution.

It is also possible to roll over a 401k to an IRA or another employers plan. Or iv the distribution is a payment. Here are some advantages a Roth IRA has over a 401k.

Annual contributions are taxed upfront and all earnings are federal tax-free when they are distributed according to IRS rulesThis is much different than a Traditional IRA which taxes withdrawalsContributions can be withdrawn any time you wish and there are no required.

Roth Ira Calculators

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

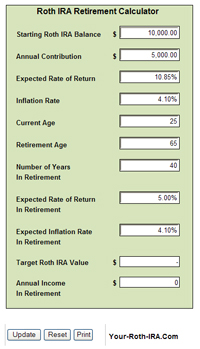

Roth Ira Calculator Roth Ira Contribution

What Is The Best Roth Ira Calculator District Capital Management

Roth Ira Calculators

Roth Ira Calculator Calculate Tax Free Amount At Retirement

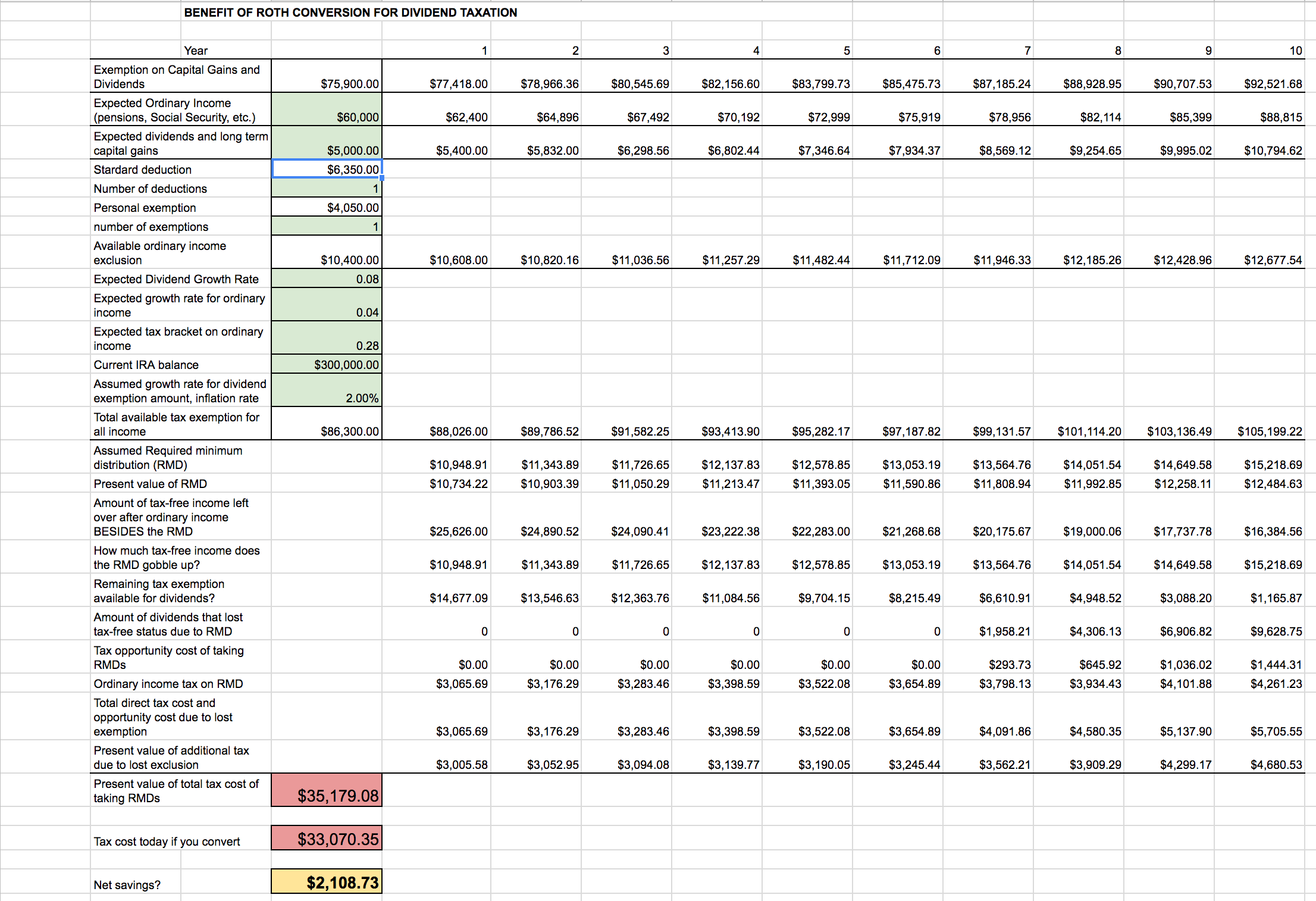

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

401k Rollover Calculator To Roth Traditional Sep Or Simple Ira

Roth Ira Conversion Spreadsheet Seeking Alpha

Traditional Vs Roth Ira Calculator

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Traditional Vs Roth Ira Calculator

Roth Ira Calculators

What Is The Best Roth Ira Calculator District Capital Management

Systematic Partial Roth Conversions Recharacterizations

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculators